Updated: January 16, 2023

The financial world has traditionally been dry on the marketing front. Money and banks aren’t funny business, and finance companies have abided by the rules of fintech engagement – until now.

More recently, the advancement of banking technology and a turn towards higher levels of customer centricity has seen fintech brands shaking up their content and digital marketing strategies to grow customer engagement with fintech audiences.

We can see fintech engagement strategies in action among the flurry of financial companies – particularly disruptive bank apps – that have shot to success by offering their clients a more personalized on-demand banking experience and better content than their traditional banking counterparts.

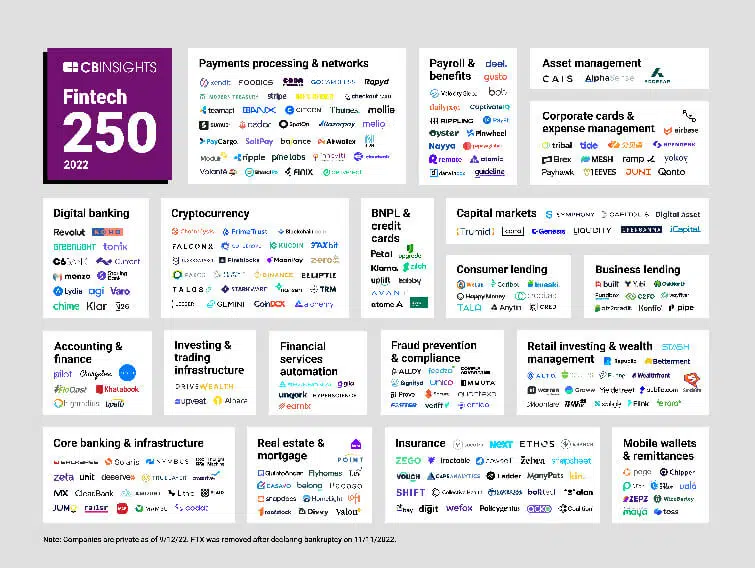

Source: CB Insights

In the fintech and banking world, you must move fast.

Technology is evolving quicker than we can keep up with and – to stay on top – you must think fast and stand out.

One of the best ways contemporary fintech brands have done this is by using content and digital strategies to improve fintech app engagement rate.

Here are a few inspiring examples of how bank app businesses can generate engagement, too.

1. Engage your audience with fintech content for the buyer journey

Content marketing is an incredibly powerful strategy, but many traditional banks have pushed it to the wayside because they believe they can’t create content that’s “exciting” enough to compete with other industries.

The truth is content is crucial in the fintech world.

In this industry, many users don’t fully understand fintech and have a lot of questions – a combination that requires content.

Take Finastra, which is a global provider of bank apps and marketplaces

Finastra is building brand authority through a wide variety of thought leadership content that educates and informs its banking audience.

How did they do this?

To do so, Finastra uses insightful content that answers real questions its prospects and clients might have during the customer journey. Content covers a broad range of topics and includes blogs, infographics, white papers, eBooks, webinars, podcasts and videos.

Source: Finastra

Steal Finastra’s idea:

- Research your audience’s pain points, questions, preferred content types and preferred channels at key points during the buyer journey. Use keyword research, surveys, market research and social listening tools.

- Develop content that specifically addresses these points and save it to the right content type for each stage of the journey.

- Use remarketing strategies to provide the right content to your customers on the channels where they are.

2. Engage fintech customers with interactive content

Creating and sharing content is one thing, but if you want clients to actively engage with the content that you’re putting out there, you must give them a push in the right direction.

This is particularly true in an industry where most audiences are used to having information pushed on them – that is, they’ve pretty much been passive receptacles to fintech marketing in the past.

SoFi, a full-service financial platform, wanted to tackle this head-on.

How did they do this?

SoFi created a resource website that works like an educational hub for young people who want to know more about full-service mortgages, student loans, investments and more. The resource center is packed full of actionable how-to guides and custom calculators that require people to get engaged if they want to use them.

Interactive tools and resources not only educate the user, but they also position SoFi as an industry leader.

In a recent marketing strategy to rebrand SoFi’s products from a student loan company to a full-service financial platform, SoFi ran digital ad campaigns across sports networks, during big sporting events and on social media platforms. The sport-related campaigns, which were targeted at its younger audience, resulted in higher conversions.

Steal SoFi’s idea:

- Put all the content you create together in a central hub that can be easily accessed.

- Develop useful tools for your customers (e.g. calculators, checklists, quizzes, etc.) using third-party plugins and automation.

- Study and understand your target audience and advertise your resources on the channels they frequent.

3. Engage customers and gain word-of-mouth marketing for your fintech business

This seems like common sense, but for a long time, traditional finance companies have been speaking to their customers like robots rather than people.

Billionaire brothers, John and Patrick Collision set the standard by tailoring Stripe products – and its marketing strategy – to solve a specific problem for a niche customer group: developers.

How did they do this?

Stripe thoroughly studies its target audience and encourages customer communication during community events and client roundups. This enables Stripe’s team to listen to feedback and evolve its products to continue meeting clients’ needs.

Additionally, Stripe supplies detailed and well-written documentation, thought leadership blog content, social media content and even book recommendations from the owners.

The Collision brothers also personally deal with user-issues and openly address friction with their team, clients and the public. As a recent Twitter kerfuffle with Plaid has demonstrated, they strive to be transparent, even in the face of unfriendly scrutiny.

The success of this approach is made apparent by Stripes customer loyalty and its business growth.

The Collision brothers’ strategy is simple. They put their customer first and created a well-developed product that solves a specific need. They build a loyal base of clients who advocate on Stripe’s behalf. They facilitate word-of-mouth selling with content marketing targeted toward their user group. And they stay above-board with transparent messaging.

Source: Stripe

Steal Collisions’ idea:

- Create a relationship with your customers by treating them like humans, solving their specific problems and opening conversations.

- Grow your brand and improve client retention by providing opportunities for them to engage with you. Show you’re listening to them by translating their feedback into actionable solutions.

- Make transparency key throughout all your messaging and always keep customers in the loop.

The future of fintech is changing

The relatively new fintech industry has finally found its stride thanks to new disruptive brands that are willing to disturb the status quo. We’re now looking to a future where finance brands are invested in becoming consumer-centric and actively trying to engage their users through educational content, interactive tools and open conversations.

Partner with a B2B marketing agency that specializes in improving customer engagement in fintech

In the end, content and digital marketing strategy provides incredible value for fintech businesses. It improves the customer experience and increases client retention. Fintech marketers who realize this and adopt a content marketing plan will lead the industry and win their market.

If you need help developing a fintech customer engagement strategy, work with an established B2B financial marketing agency. With over 20 years of financial marketing experience, Elevation uses data to gain a full view of your customer and enhance the customer experience. We can help you develop content, digital and event strategies that drive word-of-mouth marketing. Our approach can help you increase brand awareness and market share. Contact us to learn more about how our financial marketing services can benefit your company.